September 2024 Market Update for Tolland County

Here’s your September 2024 Market Update for Tolland County. This report provides an in-depth look at the latest real estate trends, economic shifts, and key market indicators shaping the region. Whether you’re a homeowner, investor, or simply interested in the local market, this update will offer valuable insights to help you stay informed.

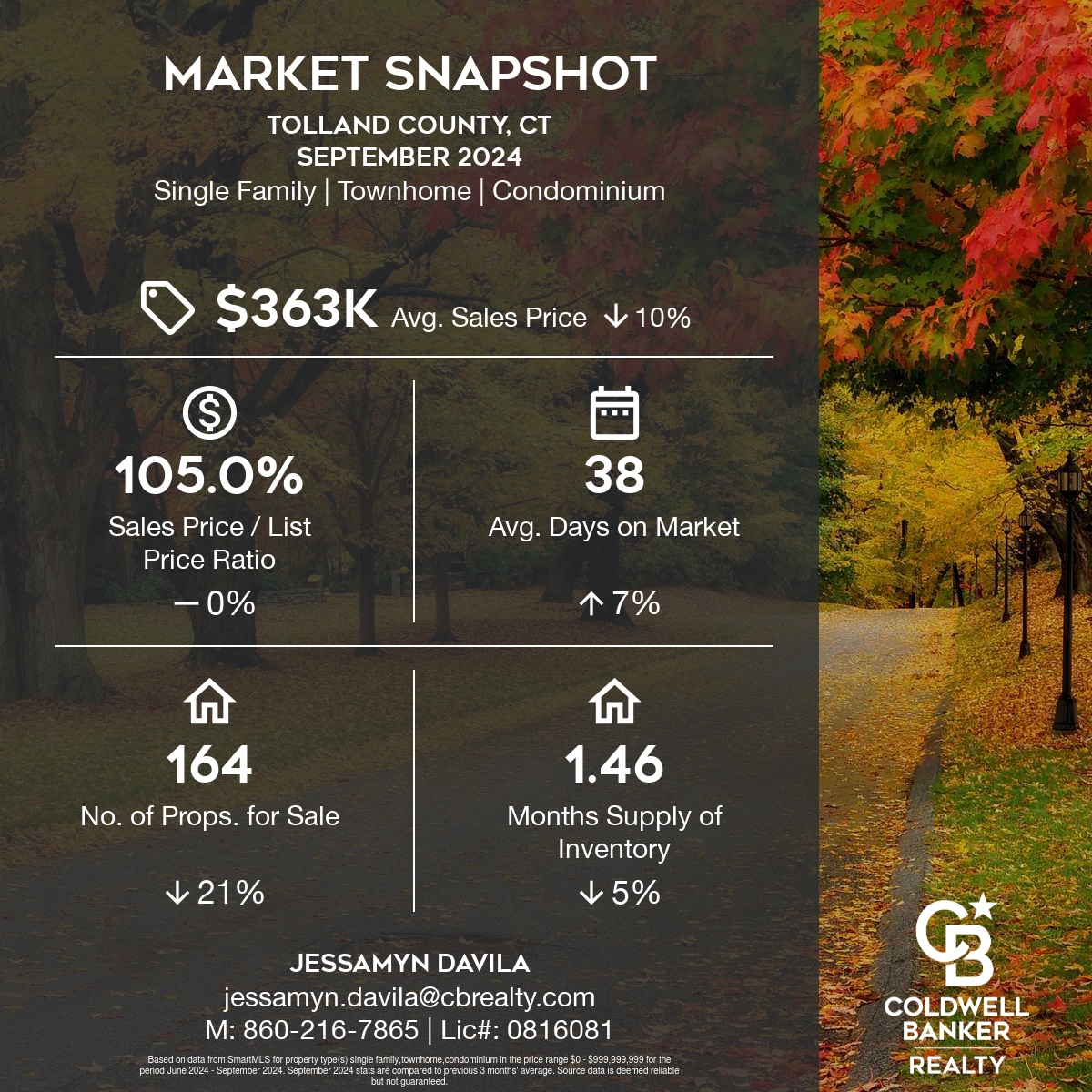

Average & Median Sales Price

-

Median Sales Price:

- September 2024: $360,000

- August 2024: $400,000 (a 10% decrease month-over-month)

- September 2023: $350,000 (a 2.86% increase year-over-year)

Despite the month-over-month decline, the median sales price in September 2024 was still at its highest level compared to September 2023 and 2022.

- Average Sales Price:

- September 2024: $363,309

- August 2024: $406,980 (a 10.73% decrease month-over-month)

- September 2023: $368,131 (a 1.31% decrease year-over-year)

The average sales price in September 2024 was lower than both the previous month and the same time last year, putting it at a mid-level compared to September 2023 and 2022.

This data indicates a cooling in the market month-over-month, but the median sales price has still seen a modest increase compared to the same time last year.

Sales Price / List Price Ratio

The sales price/list price ratio for September 2024 was 104.95%, meaning homes were selling for 4.95% more than the list price. This ratio remained unchanged compared to both the previous month (August 2024) and the same period last year (September 2023).

Number of Properties Sold & Absorption Rate

The real estate market in September 2024 experienced a noticeable drop in sales volume:

- Number of Properties Sold:

- September 2024: 112 properties

- August 2024: 149 properties (a 24.83% decrease month-over-month)

- September 2023: 120 properties (a 6.67% decrease year-over-year)

This marks the lowest sales level compared to both September 2023 and 2022, indicating a slowdown in market activity.

- Absorption Rate: The absorption rate is calculated by dividing the average number of sales per month by the total number of available properties. It reflects how quickly homes are selling relative to the current supply. A high absorption rate generally means a fast-moving market, while a low absorption rate indicates slower sales.

The drop in the number of properties sold, despite a strong sales price/list price ratio, could signal a cooling demand or a tightening inventory that might influence future price dynamics and market absorption rate. If you provide the total number of available properties, we can calculate the exact absorption rate for September 2024.

Inventory & MSI

Here’s a more detailed breakdown of the real estate market conditions for September 2024:

1. Inventory and Sales:

- Number of Properties for Sale:

- September 2024: 164 properties

- August 2024: 195 properties (a 15.90% decrease month-over-month)

- September 2023: 244 properties (a 32.79% decrease year-over-year)

This shows that the inventory is at its lowest level compared to the same period in 2023 and 2022, reflecting fewer available homes for sale, which often supports stronger pricing.

2. Months of Supply Inventory (MSI):

- September 2024 MSI: 1.46 months, meaning it would take roughly 1.46 months to sell all the available inventory at the current sales pace.

- This was the lowest MSI compared to September 2023 and 2022, signaling a strong seller’s market, where demand exceeds supply. A lower MSI benefits sellers because homes sell quickly, often leading to higher prices.

Key Takeaways:

- The market is clearly tight with declining inventory and a low MSI, benefiting sellers.

- The absorption rate suggests properties are moving swiftly, while the low MSI reflects increased competition among buyers for limited listings.

- Despite fewer sales and properties sold, the 104.95% sales price/list price ratio shows buyers are still willing to pay over the list price.

- Homes are consistently selling above the list price, suggesting strong demand or limited inventory.

- The fact that the sales price/list ratio remained stable at 104.95% across the past year indicates a persistent seller’s market, where buyers may be competing for properties, driving up sale prices above the listed values.

Click here to access the full report with additional data.

Sign up here for Neighborhood News – The Real Estate Market scoop for the community you love.

August 2024 Market Update for Tolland County

Here’s your August 2024 Market Update for Tolland County.

Average & Median Sales Price

The median sales price in August 2024 was $397,500, up 1.95% from $389,900 from the previous month and 20.45% higher than $330,000 from August 2023. The August 2024 median sales price was at its highest level compared to August 2023 and 2022. The average sales price in August 2024 was $406,081, equal to the previous month and 10.23% higher than $368,405 from August 2023. The August 2024 average sale price was at its highest level compared to August 2023 and 2022.

Sales Price / List Price Ratio

The sales price/list price ratio is the average sale price divided by the average list price for sold properties expressed as a percentage. If it is above 100%, homes are selling for more than the list price. If it is less than 100%, homes are selling for less than the list price.The August 2024 sales price/list price ratio was 104.82%, equal to the previous month and equal to August 2023.

Number of Properties Sold & Absorption Rate

The number of properties sold in August 2024 was 148, up 8.03% from 137 from the previous month and 8.03% higher than 137 from August 2023. The August 2024 sales were at a mid level compared to August 2023 and 2022. Absorption rate is the avg number of sales per month divided by the total number of available properties.

Inventory & MSI

The number of properties for sale in August 2024 was 157, down -23.79% from 206 from the previous month and -37.70% lower than 252 from August 2023. The August 2024 inventory was at its lowest level compared with August 2023 and 2022. A comparatively lower MSI is more beneficial for sellers while a higher MSI is better for buyers. The August 2024 MSI of 1.06 months was at its lowest level compared with August 2023 and 2022.

The number of properties for sale in August 2024 was 157, down -23.79% from 206 from the previous month and -37.70% lower than 252 from August 2023. The August 2024 inventory was at its lowest level compared with August 2023 and 2022. A comparatively lower MSI is more beneficial for sellers while a higher MSI is better for buyers. The August 2024 MSI of 1.06 months was at its lowest level compared with August 2023 and 2022.

Click here to access the full report with additional data.

Sign up here for Neighborhood News – The Real Estate Market scoop for the community you love.

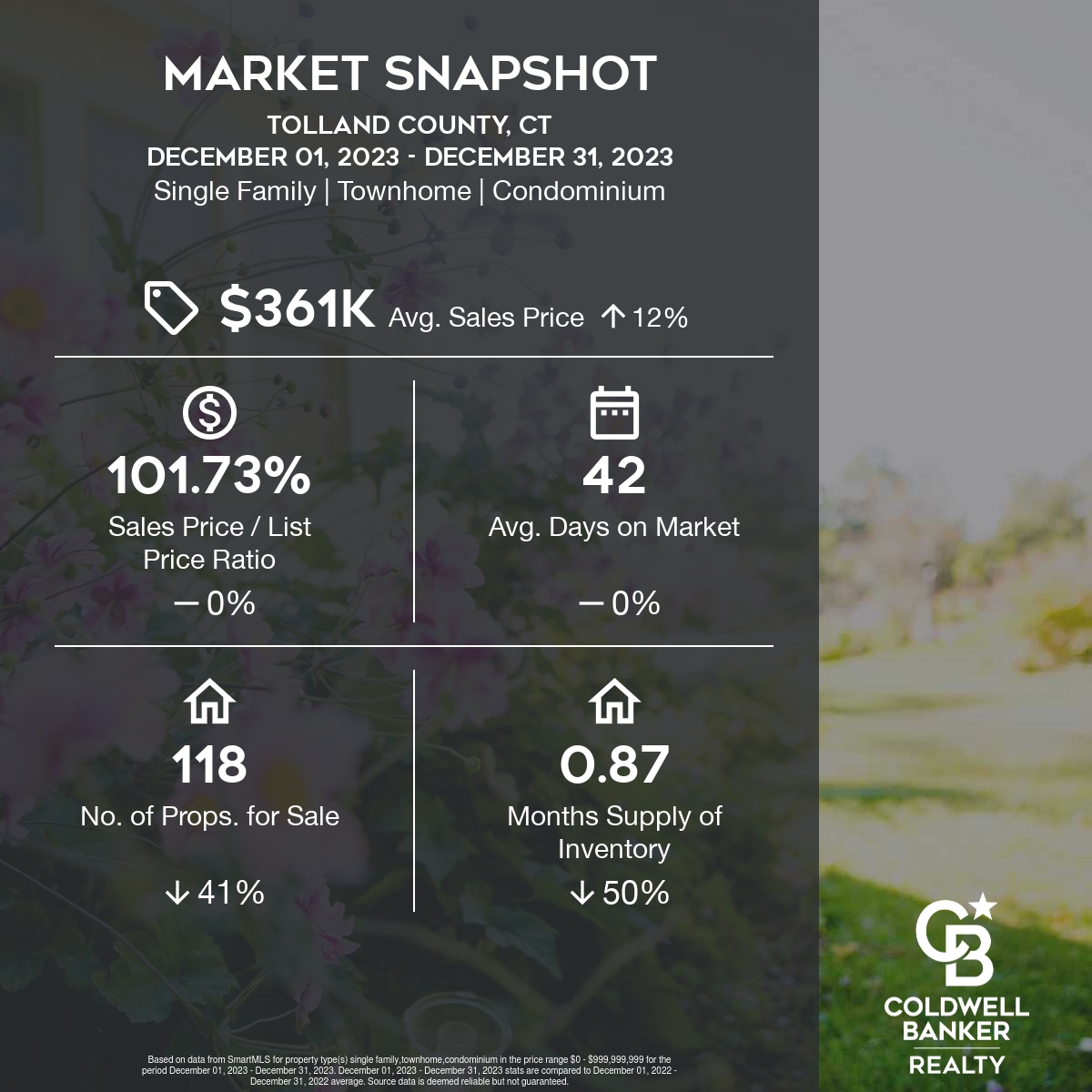

December 2023 Market Update for Tolland County

Here’s your December 2023 Market Update for Tolland County.

Average & Median Sales Price

The median sales price in December 2023 was $350,000 – up 9.03% from the previous month and 16.67% higher than December of 2022. The December 2023 median sales price was at its highest level compared to December 2022 and 2021. The average sales price in December 2023 was $361,357, up 8.88% from the previous month and 11.67% higher than December 2022.

Sales Price / List Price Ratio

The sales price/list ratio is the average sales price divided by the average list price for sold properties, expressed as a percentage. If it is above 100%, homes are selling for more than the list price. If it is less than 100% homes are selling for less than the list price. The December 2023 pals price/list price ratio was 101.74%, down from 103.07% from the previous month and equal to December 2022.

Number of Properties Sold & Absorption Rate

The number of properties sold in December 2023 was 135, up 26.17% from the 107 sold the previous month and 17.39% higher than the 115 from December 2022. The December 2023 sales were at a mid level compared to December 2022 and 2021. Absorption rate is the average number of sales per month divided by the total number of available properties.

Inventory & MSI

The number of properties for sale in December 2023 was 118, down -39.49% from the 195 available the previous month and -41.00% lower than the 200 available on December 2022. The December 2023 inventory was at its lowest level compared with December 2022 and 2021.

MSI stands for Monthly Supply of Inventory. A comparatively lower MSI is more beneficial for sellers while a higher MSI is better for buyers. The December 2023 MSI of 0.87 months was at its lowest level compared with December 2022 and 2021.

Click here to access the full report with additional data.

Sign up here for Neighborhood News – The Real Estate Market scoop for the community you love.

7 Projects You Can Tackle In Winter To Get Your Home Ready For Spring

Spring is the perfect time to give your home a fresh new look. Whether you are planning to put your house up for sale or simply want to spruce it up, there are a few things you can do now to make it look its best and have it ready for Spring.

Here are 7 projects you can tackle in the Winter, to get your home ready for Spring:

1. Declutter

1. Declutter

Clutter can have a negative impact on your mental health and can make your home feel chaotic and overwhelming. Start by getting rid of any unnecessary items in your home. Donate or sell items that you no longer need or use. Ask yourself if each item is truly necessary or if it’s just taking up space. You’ll not only free up space in your home, but you’ll also be doing something good for others. So clear out the clutter and enjoy a more serene living space.

2. Deep clean

2. Deep clean

Give your home a thorough cleaning. This includes dusting, vacuuming, and washing all surfaces. A deep clean can be an incredibly satisfying way to give your home a fresh start. Taking the time to dust and vacuum all those hard-to-reach corners can make a big difference in the overall cleanliness of your space. Don’t forget to wash all surfaces, from countertops to floors, to remove any dirt or grime that may have accumulated. With a little elbow grease, you’ll be amazed at how sparkling clean your home can be!

3. Paint

3. Paint

Painting is one of the most cost-effective ways to improve your home’s appearance. Compared to other renovation projects, painting is relatively inexpensive and can have a big impact on the overall look and feel of your home. A fresh coat of paint can make your home feel more welcoming and cozy.

4. Add some color

4. Add some color

Adding colors to your home décor can work wonders in uplifting your mood and giving your space a vibrant feel. Start with small changes like incorporating colorful throw pillows or a rug with a bold pattern. If you’re feeling adventurous, you can try painting an accent wall in a bright hue or hanging up colorful artwork to create a focal point in the room. A little color can go a long way in transforming your home into a cozy space that reflects your personality and style.

5. Bring in some plants

5. Bring in some plants

Indoor plants are a great way to add life and vibrancy to any living space. Not only do they bring a pop of color to your home, but they can also help purify the air you breathe. Plants act as natural air filters, removing harmful toxins and pollutants from the air and replacing them with fresh oxygen. Adding a few plants to your living room, bedroom, or kitchen can also create a calming and peaceful atmosphere. So why not bring some nature indoors?

6. Update your curtains

It’s time to give your home a fresh and airy feel. Heavy winter curtains can make a room feel stuffy and dark, but lighter and breezier curtains can instantly brighten up your space. Opt for fabrics like linen, sheer cotton, or even bamboo to let in natural light and create a relaxing atmosphere. This simple change will help you embrace the season, while enhancing the overall look and feel of your home. So go ahead, switch out those heavy drapes and welcome in the springtime vibes!

7. Update your lighting

7. Update your lighting

Add some new lamps or light fixtures to brighten up your home and create a cozy atmosphere. Lighting plays a crucial role in making your home feel comfortable and inviting. If your space feels dull or uninspiring, adding some new lamps or light fixtures can help create a warm and inviting ambiance.

7 Questions Buyers Should Ask Before Hiring an Agent

Buying a home is definitely one of the most important decisions we make. Your real estate agent will play a big role in the process, and can definitely ensure that it is a smooth and pleasant experience. They will be responsible for many moving parts both during your search and after you find the property of your dreams. Asking the right questions , before deciding who you are hiring is an essential part of the process.

Here are 7 questions you should ask your real estate agent before you start working with them in your home search.

1.What experience do you have in real estate?

Asking this question can give you a better understanding of the level of expertise they can offer you and how well they know the local real estate market. Having an experienced agent on your side will be invaluable when it comes to navigating the complexities of real estate transactions. An experienced real estate agent can provide advice on market conditions, help you determine your budget, and guide you through the negotiation process. Ultimately, having a real estate agent with extensive experience can make the home buying or selling process easier and more successful.

2. Can you provide client references?

I think this is definitely the most important question to ask. When people are truly happy with the service provided by their agent, they will rave about it on social media, Zillow, or Google reviews. Some past clients might even be happy to answer the phone to tell you about their experience. Asking your agent for past references will give you insight into their past work performance. Having references will help you get a better understanding of their level of expertise, customer service, and overall success in the real estate industry. Additionally, it can provide you with the assurance that your agent is knowledgeable and trustworthy. You are going to want an agent by your side who takes great care of their clients.

3. How long have you been a real estate agent for?

Ok, so we all have to start somewhere. As an agent I am very grateful for the opportunities my first clients gave me. But in reality, experience is definitely your best friend in real estate. With so many moving parts in a real estate transaction, you are going to want someone who can successfully negotiate an offer on your behalf and guide you through the rest of the process.

4. How long do you usually work with buyers, from the moment they start they’re search all the way up to the closing table?

The average buyer takes 4-8 weeks to find the home of their dreams and 30-45 days thereafter to close on their home. If an agent is telling you that they usually work with buyers for longer than 5 months, that’s a red flag. Of course, there will be exceptions to that, but overall you’ll want to work with someone who’ll have you in your new home within 2-4 months. This question will also give you a good indication of the level of commitment and dedication your agent will have towards helping you find and purchase the perfect home. Knowing the timeline your agent usually works within, can also help you plan your own search effectively. You are going to want to have an idea of how long it may take for you to close on a home.

5. Are you a full-time or a part-time agent?

A full-time agent will be able to devote more time to you as a buyer. Asking this question will give you insight into their dedication to the job. A full-time agent is more likely to have more experience and be more knowledgeable about the local market, current trends, and even more specialized aspects of real estate. Part-time agents may not have the same level of expertise and may not be as available to answer questions or take action when you need them to. It’s important to have an agent who is knowledgeable and available to help you make the best decisions for your home buying process. Ultimately, in a fast-paced market like the one we are currently experiencing, you are going to want to work with an agent that is available to service your needs in a timely manner.

6. How do you help buyers compete in this market?

In a competitive market, you will need an agent who’s a fierce negotiator and who has your best interest as a priority. By asking this question, your agent can provide you with valuable insight and advice on the current market trends. They can help you understand the process of bidding and competing with other buyers, and provide you with strategies and advice to help you get the best deal. Make sure you also ask how many offers on average they submit in their client’s behalf before one gets accepted. This will give you great insight on whether their strategy is a highly successful one or not.

7. How do you ensure that buyers are getting the best possible deal?

This is one of the most important aspects of the home buying process. An agent’s expertise, experience, and knowledge of the local market can help buyers make sure that they are getting a fair deal. A good agent will be able to negotiate effectively on the buyer’s behalf and look out for their best interests. Additionally, an agent can provide useful advice on the best time to buy, the best ways to finance a home, and the best strategies for getting the best deal.

Summary:

Finally, the decision of which agent you will decide to hire to help you with your home search has to feel right from the beginning. By interviewing your prospective agent you will get an idea of whether your expectations and their initial presentation are a match. Ultimately, having an agent who is knowledgeable and experienced in the local market can help buyers make sure that they are getting the best possible deal, while making the process a seamless one from beginning to end.

Let’s get in touch so I can answer all your questions about the buying process.

Tips for First Time Home Buyers in a Competitive Market

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

1. Declutter

1. Declutter 2. Deep clean

2. Deep clean 3. Paint

3. Paint  4. Add some color

4. Add some color  5. Bring in some plants

5. Bring in some plants

7. Update your lighting

7. Update your lighting